Turn2us Annual Report 2023-24: Our impact and learnings

- Published

- 06/01/2025

Turn2us is a national charity that offers practical help and support to those of us facing financial shocks and together we challenge the systems and perceptions that cause financial insecurity. Our vision is that everyone in the UK has financial security so they can thrive.

This annual report looks back at just some of the work undertaken by Turn2us between April 2023 to March 2024 – sharing our recent impact and learnings, as we continue to deliver against our ambitious five-year strategy.

No organisation can have meaningful impact without collaboration and so we wish to thank our partners, supporters and the communities that help drive forward our developing campaigns programmes work.

Building on its 2023-2028 strategy, Tackling Financial Insecurity Together, the charity continues to support individuals facing financial shocks while challenging the systems and perceptions that cause financial insecurity.

Over this period, we continued to strengthen communities through our place-based work, widened our network of supporters to help fund our ambitious programmes and were led by lived experience in the design of our newest online tool.

How we made a difference in 2023-24

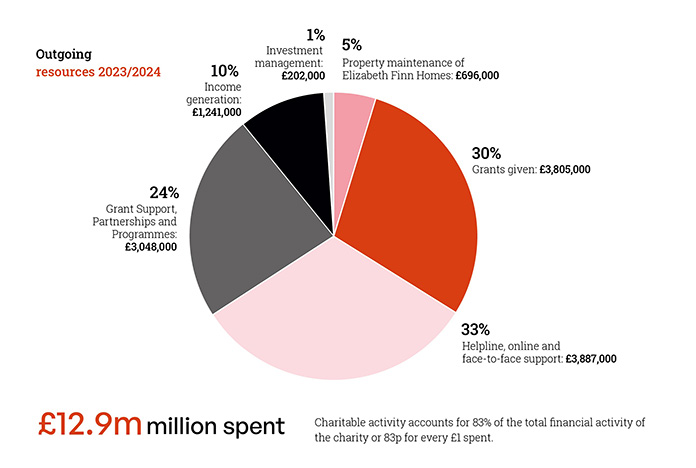

- We made grants of nearly £3.3m, supporting 2,277 people across the UK.

- Our online Grants Search was used more than 950,000 times, helping people find extra money to give them vital breathing space. These grants don’t impact benefits and don’t need to be paid back.

- People completed over 2.5 million calculations using the free Turn2us Benefits Calculator.

- 1.6 million Benefits Calculator users found new benefits to apply for.

- 5.8 million people used our website looking for information to help them claim the support they’re entitled to.

- Our helpline received over 80,500 enquiries or requests from people needing support to access tools and information.

Key achievements in 2023-2024

- Over this period, we finalised the key features of the Turn2us PIP Helper tool, designed with co-production partners, to simplify the complex process of applying for Personal Independence Payment (PIP). This new tool was launched for users and advisers in Autumn 2024.

- From Middlesbrough to Edinburgh, Turn2us partnered with local organisations to co-design and deliver grant programmes. Efforts in Edinburgh included a £1 million commitment to the Regenerative Futures Fund to tackle poverty through long-term community engagement and by ensuring key decisions are made by people in those communities.

- The charity distributed nearly £3.3 million in grants, supporting over 2,200 individuals. Notable initiatives included the Crisis Response Programme and the newly launched Positive Futures programme, which offered people in minoritised communities funding for job retraining, moving house and driving lessons, amongst other things to help them thrive.

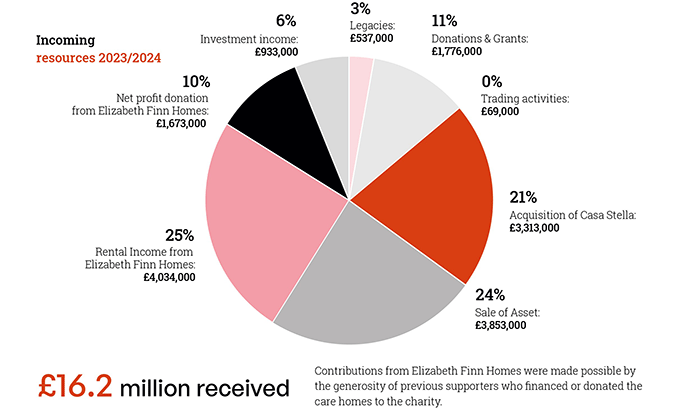

- Fundraising reached new heights with £2.34 million in voluntary income and significant contributions from corporate partnerships, including Royal London and People’s Postcode Lottery.

- Elizabeth Finn Homes, the charity’s care home subsidiary, doubled its financial contribution to Turn2us this year, providing £5.4 million.

- Turn2us strengthened its campaign efforts, addressing systemic inequities like the two-child benefit cap and Universal Credit inadequacies. Key initiatives included an All-Party Parliamentary Group meeting on Universal Credit and gender, amplifying the voices of women impacted by financial insecurity.

Ambition for the future

We remain steadfast in our commitment to a fair and just economy. Looking ahead, we plan to reach more people with our tools through targeted campaigns and a strengthened brand.

We will continue to improve our online tools whilst also furthering our place-based programmes, to deepen our impact. All this critical work will be informed by co-production with people who have lived experience of financial insecurity and navigating the social security system.

In the year ahead, we will be focusing more on systemic change, in line with our vision of a society where financial security is a reality for everyone. We look forward to working with our partners and supporters to deliver on this vital work.